This is a big step and often takes unknowing people out of the game without proper guidance. This shaves years off your time to master these concepts. This is where we use technology to start making personal application of all your education quickly. Next you will start building muscle as you back trade. Profits will be low and losses significant at this stage which is why we always train with virtual funds. Let’s talk about that…įirst, as a beginner, everything is new to you and your focus must be on education.

Without the Ultimate Trading Formula, your path to success could be frustrating, unpredictable and pricy!Įven with the winning formula, we know there are four distinct phases that you will progress through. This type of hands-on experience can be invaluable when it comes to developing the confidence and skills needed to succeed in the stock market. Students are also able to practice their skills in a safe environment before they start investing their own money. This allows for a more personalized approach to education that can lead to better outcomes. Moreover, through apprenticeship education, students can learn at their own pace and customize their learning experience according to their strengths and weaknesses. By learning from experienced professionals who have years of experience in trading, students can gain a more nuanced understanding of the industry, as well as valuable insights into the practical aspects of trading.

#Stock market rising wedge how to#

At TradeSmart University, we believe that this model is particularly well-suited for teaching people how to navigate the stock market. In order to avoid false breakouts, you should wait for a candle to close below the bottom trend line before entering.The apprenticeship education model is a time-tested and effective way of learning that combines both theoretical and practical learning.

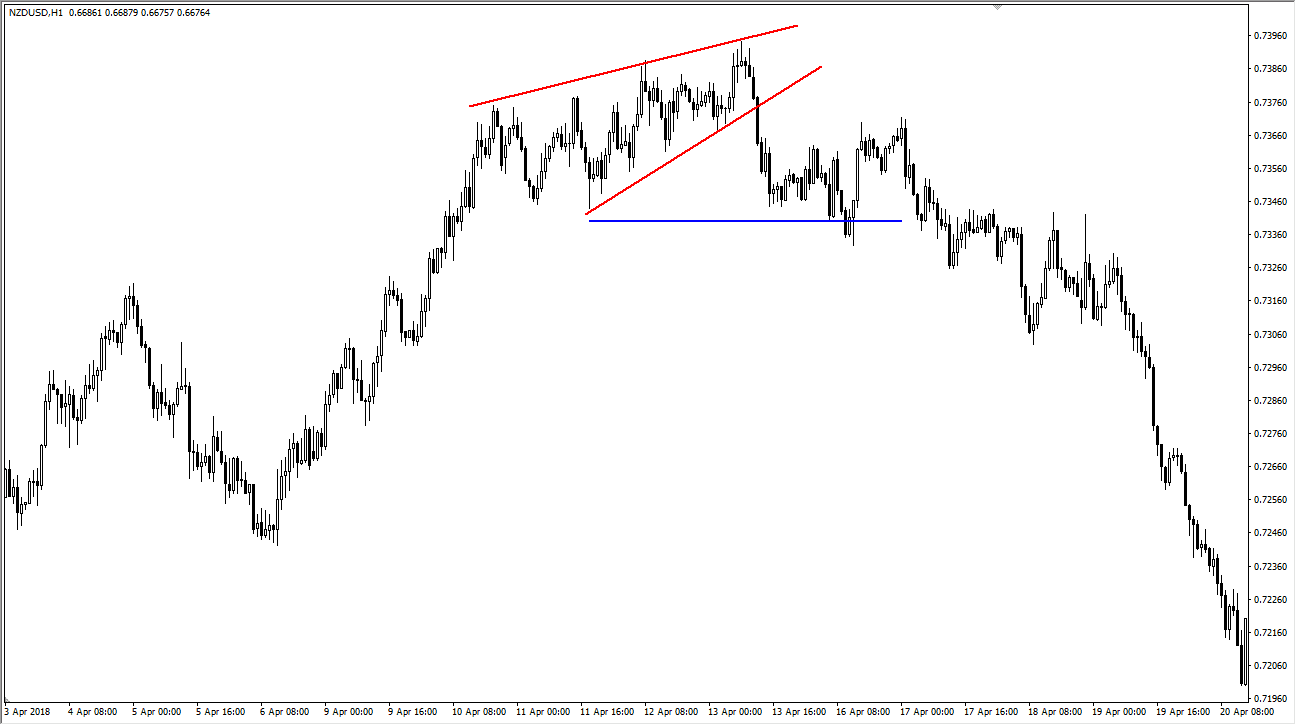

Once you have identified the rising wedge (whether in a uptrend or downtrend), one method you can use to enter the market with is to place a sell order (short entry) on the break of the bottom side of the wedge. The charts below show an example of a rising wedge pattern in a downtrend: It indicates the continuation of the downtrend and, again, this means that you can look for potential selling opportunities. As in the case of a rising wedge in a uptrend, it is characterised by shrinking prices that are confined within two lines coming together to form a pattern. Identifying the rising wedge pattern in an downtrendĪ rising wedge in a downtrend is a temporary price movement in the opposite direction (market retracement).

This means that you can look for potential selling opportunities. This indicates a slowing of momentum and it usually precedes a reversal to the downside. The price is confined within two lines which get closer together to create a pattern. As the chart below shows, this is identified by a contracting range in prices. Identifying the rising wedge pattern in an uptrendĪ rising wedge in an uptrend is considered a reversal pattern that occurs when the price is making higher highs and higher lows. This lesson shows you how to identify the rising wedge pattern and how you can use it to look for possible selling opportunities. There are two types of wedge pattern: the rising (or ascending) wedge and the falling (or descending wedge). The wedge pattern can be used as either a continuation or reversal pattern, depending on where it is found on a price chart.

0 kommentar(er)

0 kommentar(er)